European Office Space – Far More Than Commercially Viable

- European Office Space demand is strongly divided and motivated by different matters not only related to the healthy economic cycle

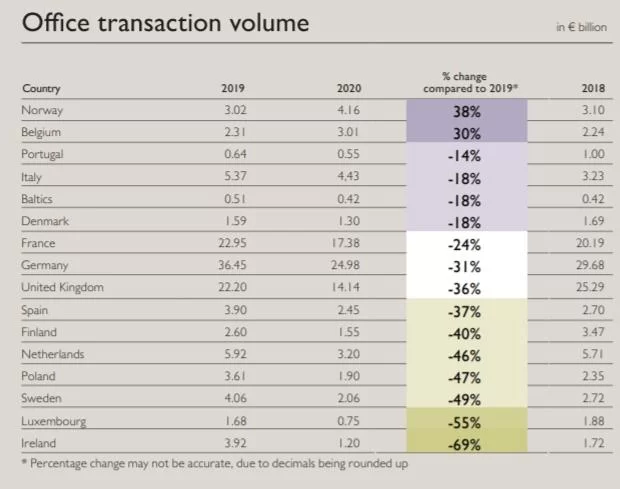

- Researches have shown that the lockdowns have however threatened the lease market for office space and have decreased 40 per cent over the same timeframe of 2019 over the first three quarters of 2020 have analysed as 38 European office building markets within Europe and concluded that the number of transactions in Europe (including in the United Kingdom) is decreasing, as part of the European study.

- The highest declines were observed in Ireland (-69%), Luxembourg (-55%), and Sweden (-49%). The markets with returns below 3% and expensive but lucrative for investors to consider as they’re expected to bounce back.

- The sector is well placed for reactivation, provided that the lockdowns are meek and wide vaccination is available

- As of mid-2020 all primary rentals and returns remain virtually unchanged, while vacancies have risen moderately, which indicates unchanged strong investor interest

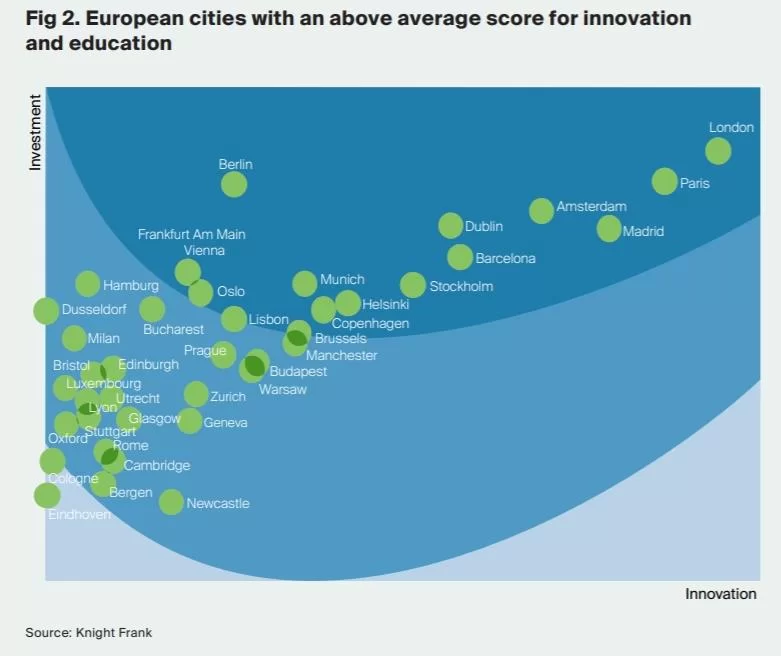

The demand for the European Office Space is based on several main topics, not just economic health – the economic cycle is not the only driver. In addition, demand is influenced by long-term systemic factors and issues such as population ageing, economic change, technology, and urbanization. Despite the vast sums of capital pouring in and out, consumer appetite remains extremely concentrated. In comparison to the flat prices or declines in other industries, retail yields are yet on the rise (Fig 2).

Opportunity Rich Sector For Investors

Although the COVID-19 pandemic has significant consequences on economic growth, the European Office’s room for recovery is well placed. Investment volumes are anticipated to rebound to pre-pandemic standards by 2022, according to different business viewpoints. The GDP of the euro area is expected to contract by 7.3% in 2020 and to rebound by 4.6% in 2021, provided there is easy lock-down and a broader vaccination is available.

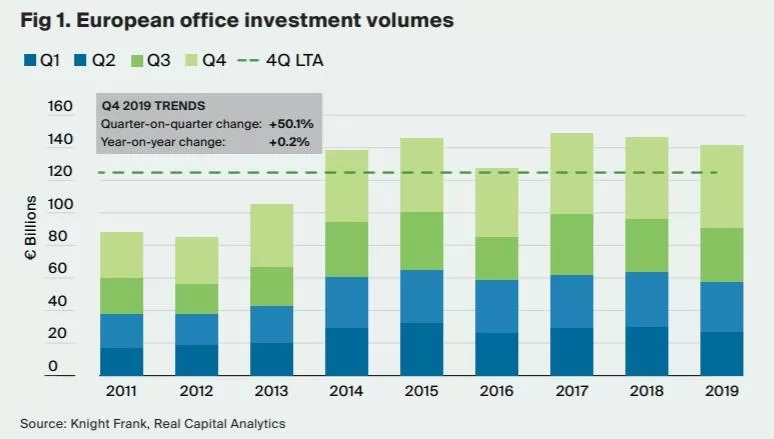

The lockdowns made it increasingly difficult for the office rental market to emerge profitable over the first three quarters of 2020. But in 2021, we expect improvement, with continuing demand in primary city locations for high-quality, amenity-rich areas (Fig-1).

Few Transactions, Stable Rents, And Rising Yields

Investors continue to favour offices in cities such as Amsterdam, Berlin, Copenhagen, Paris, Munich, Manchester, London, and Stockholm, with different economies.

Most office spaces in Europe are used below average after 12 months of the pandemic. Back in 2020, €83.5bn is transacted in office spaces. Researches have shown that the lockdowns have however threatened the lease market for office space and have decreased 40 per cent over the same timeframe of 2019 over the first three quarters of 2020 & have analysed as 38 European office building markets within Europe and concluded that the number of transactions in Europe (including in the United Kingdom) is decreasing, as part of the European study.

The volume decreased more dramatically in pandemic affected regions, some of which had lengthy lockdowns. The highest declines were observed in Ireland (-69%), Luxembourg (-55%), and Sweden (-49%).

However, transaction volumes grew by 38% in Norway and 30% in Belgium in relation to last year’s same period (Fig-3).

The price growth was able to largely avoid the negative trend in the letting markets and investment volumes. After mid-2020, all prime rents and yields have stayed almost constant amid a modest uptick in vacancies, highlighting the unmoving strong investor interest.

Few Transactions, Stable Rents, And Rising Yields

Here are the other important highlights for the European Office Space

- The average primary office rent in all 38 markets is almost stable in comparison with H1 2020 at +0.59%, even though certain competitive price changes have also occurred.

- London West End is at €108.00/sqm the costliest market for offices. The Baltic towns of Vilnius, Riga, and Tallinn are the lowest luxury rentals (Fig 3).

- The heavy reduction in yield has subsided in recent years. The overall net prime return for any market, at 4.12 %, is the same as in the last year’s review.

- In the top seven German markets, the lowest returns are below 3% and therefore the most expensive stock markets in Europe. However, lucrative yield options are provided to several Finnish markets and Baltic states.

- Amid current uncertainties resulting from the COVID-19 pandemic, just about 30% of office markets foresee a turnaround in rental rates. In nine European office markets at the end of 2021, we just see marginally decreasing expected prices (> 3.0 basis points). The bulk of economies are continually stagnating.

- As demand for new core buildings continues to be strong, net premium yields over the whole year should be steady.

- There are estimates that only 3 out of 38 economies will rise by year-end, with outputs projected to remain constant in the remaining countries (> 5.0 basis points).

- There is a differentiated condition between the industry participants. There are, on the one hand, current leases that will remain but are ready for grabs in the next few years. There are also new lettings that can reach an ever-low number of new developments.

- Investors with long-term investment opportunities due to COVID-19 would be much more interested in office assets with a ranking of “core” or “trophy.”

- The consistency of the tenant system would also become highly critical in terms of creditworthiness and business.

- In addition to the low volatility and a greater regional and local sector reference, a secondary location in strategic portfolio investment should be considered.

- In the vacancy indicator, we would be seeing a created, latent base vacancy in the Grade-B / localized property system in places where the value-added positions of the Central Business District or central transport hubs with a limited number of new construction sites.

Conclusion: There Will Be Fresh Prospects

In 2020 the real estate markets have seen a huge disruption, with a COVID-19 pandemic that puts an immediate cessation to the previous economic cycle. The effect and recovery won’t be identical in all fields and geographies, but there will be new prospects and the probable launch of vaccinations is the basis for a sustained recovery in 2021.